Key Takeaways to Avoid the 90% Failure Rate

- Validate Rigorously: Never scale a business until you have undeniable, quantitative proof of Product-Market Fit. A solution without a paying problem is a hobby, not a business.

- Manage Cash Ruthlessly: Treat your Cash Runway as your most precious resource. Prioritize profitability and maintain a minimum of 12-18 months of operating capital to weather unexpected market shifts.

- Invest Strategically in Visibility: In the digital age, a lack of visibility is a death sentence. Strategic investment in Startup SEO and professional web development is the most cost-effective way to secure long-term, sustainable growth and prove Market Demand.

Startup Failure Rate Statistics (2025): What Does the Data Say?

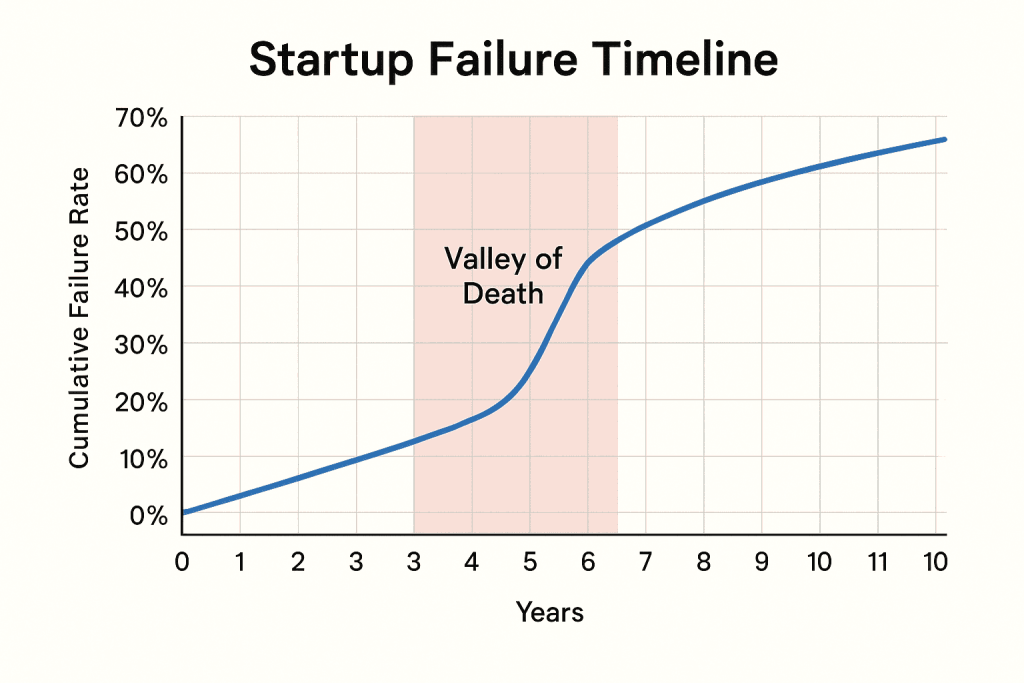

| Timeframe | Estimated Failure Rate | Key Takeaway |

|---|---|---|

| Overall | Up to 90% | The long-term risk of failure remains extremely high across all sectors. |

| First Year | ~10% | Initial failure is often due to fundamental flaws like lack of funding or legal issues. |

| Years 2 to 5 | ~70% of those remaining | This is the “Valley of Death,” where the majority of failures occur, primarily due to scaling issues and an inability to achieve Product-Market Fit. |

| After Year 10 | ~30% of those remaining | While survival rates improve, sustained success requires constant innovation and adaptation. |

The data for 2025, compiled from sources like Exploding Topics and Failory, confirms that the most perilous period for a startup is between its second and fifth year . This is when the initial excitement fades, seed funding runs dry, and the company must prove its long-term viability. The sheer volume of new market entrants and the accelerating pace of technological change mean that the competitive landscape is more brutal than ever, making a deep understanding of why startups fail essential.

Startup Failure Rate Statistics (2024): The Preceding Trends

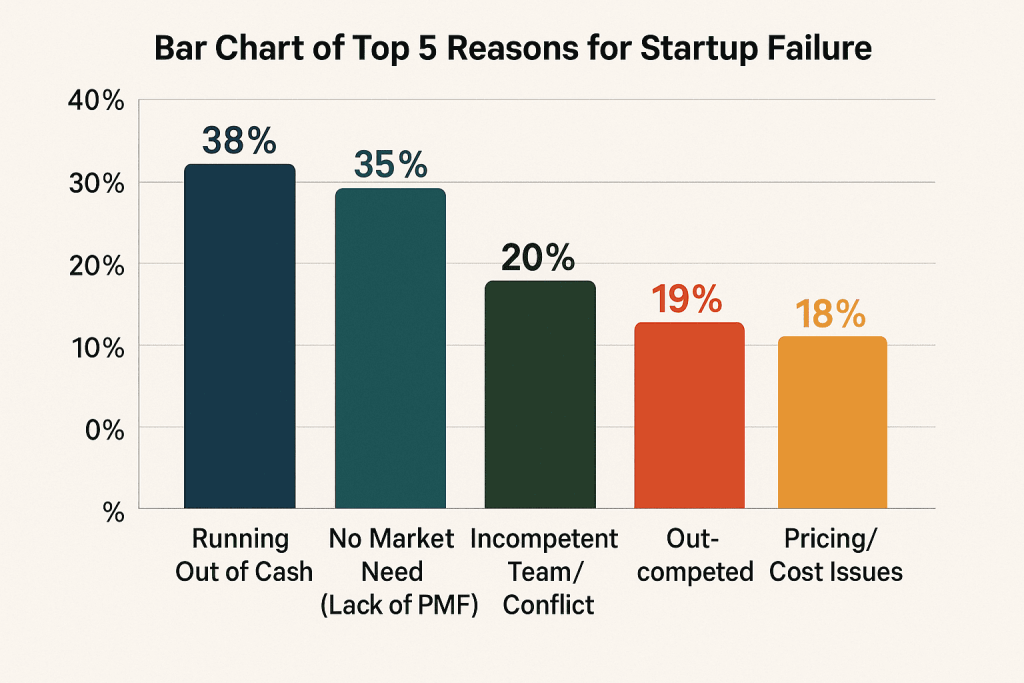

A 2024 analysis of thousands of failed startups identified the top five reasons for failure, which serve as foundational entities for our discussion:

| Rank | Reason for Failure | Percentage | Core Entity |

|---|---|---|---|

| 1 | Running Out of Cash | 38% | Cash Runway |

| 2 | No Market Need (Lack of PMF) | 35% | Product-Market Fit |

| 3 | Incompetent Team / Conflict | 20% | Team Dynamics |

| 4 | Outcompeted | 19% | Market Demand |

| 5 | Pricing / Cost Issues | 18% | Financial Modeling |

These statistics from 2024 underscore a timeless lesson: failure is rarely due to a single, catastrophic event. It is typically the result of a compounding series of poor decisions and a failure to address fundamental business entities.

Top Reasons Startups Fail: Deep Dive into the Core Entities

To truly understand why startups fail, we must move beyond simple bullet points and analyze the core entities that dictate a company’s success or demise. The following are the most critical, interconnected reasons that contribute to the high failure rate.

1. Why Do Startups Fail to Achieve Product-Market Fit?

- Ignoring the Market: Many founders develop a solution in a vacuum, convinced of its brilliance without validating the actual Market Demand. They skip rigorous market research and customer interviews, leading to a product that solves a problem no one is willing to pay for.

- Case Study Example (Premature Launch): A founder builds a highly complex, feature-rich B2B SaaS platform over two years without speaking to a single potential customer. Upon launch, they discover the target market uses a completely different workflow, and the product is too complicated for their needs. The founder’s vision, though technically impressive, had no market correlation, leading to a swift failure to gain traction.

- Premature Scaling: Launching an aggressive marketing and hiring campaign before PMF is confirmed is a guaranteed way to exhaust the Cash Runway. Scaling a flawed product only accelerates failure.

- Poor Iteration: The inability to listen to user feedback and pivot the product effectively prevents the necessary evolution required to find PMF. This is often a failure of ego, where founders are too attached to their initial vision.

2. How Does Running Out of Cash Become the Ultimate Failure Point?

- Mismanaging Cash Runway: The Cash Runway—the number of months a company can operate before running out of money—is constantly miscalculated. Startups often underestimate expenses (especially customer acquisition costs) and overestimate revenue timelines.

- Case Study Example (Burn Rate): A well-funded startup raises $5 million but hires a large team and rents expensive office space immediately. Their monthly burn rate is $250,000, giving them a 20-month runway. When a key product launch is delayed by six months, they are forced to do massive layoffs and a “down round” of funding, effectively failing to meet their initial potential.

- Over-reliance on Funding: Bootstrapped or venture-backed, a startup must have a clear path to profitability. An over-reliance on the next funding round without a sustainable business model is a fatal flaw. This is where efficient project management becomes vital, ensuring resources are used optimally and milestones are hit on time.

- High Customer Acquisition Cost (CAC): If the cost to acquire a customer is higher than the lifetime value (LTV) they bring, the business model is broken. This often ties back to ineffective marketing, a lack of Startup SEO strategies , or a poor value proposition.

3. What Role Does Team Dynamics Play in Startup Collapse?

- Founder Conflict: Disagreements between founders over vision, equity, or workload are a major cause of early-stage failure. These conflicts consume valuable time and energy, diverting focus from the product and the market.

- Case Study Example (Equity Dispute): Two founders, one technical and one business-focused, start with a 50/50 equity split. Six months in, the business founder feels the technical co-founder is not pulling their weight. Because they failed to establish a Founder Agreement with vesting, the dispute escalates, leading to a legal battle and the eventual dissolution of the company, despite having a promising product.

- Lack of Essential Skills: A founding team must possess a diverse set of skills: technical expertise, business acumen, and marketing/sales capabilities. A team composed solely of engineers or solely of business people will have critical blind spots.

- Hiring Mistakes: Hiring too quickly, hiring people who are not a cultural fit, or failing to let go of underperforming employees can rapidly poison the work environment and drain the Cash Runway.

How Can Founders Mitigate Internal Conflict and Build a Strong Culture?

- Establish a Clear Founder Agreement: Before incorporating, define roles, responsibilities, decision-making processes (especially for tie-breaking), and a vesting schedule for equity. Vesting (typically over four years with a one-year cliff) ensures that equity is earned over time, protecting the company if a founder leaves early.

- Prioritize Cultural Fit Over Skill: While skills are essential, a toxic but talented employee can do more damage than a less-skilled but highly collaborative one. Hire people who share the core values of the company.

- Implement Conflict Resolution Mechanisms: Establish a formal process for addressing disagreements. This prevents minor issues from festering into company-killing disputes.

4. Why Do Marketing and Sales Fail to Drive Growth?

- Poor Online Visibility: In the digital age, a lack of a cohesive digital presence is a death sentence. Many startups neglect the importance of Startup SEO and comprehensive digital marketing, failing to appear where their customers are searching. For a B2B or SaaS company, this often means underinvesting in SaaS SEO and technical content that establishes authority.

- Inconsistent Messaging: Confusing or inconsistent messaging about the product’s value proposition fails to resonate with the target audience.

- Ignoring Distribution Channels: A great product with no distribution is a hobby, not a business. Failure to identify and master the most effective channels to reach the target Market Demand is a common mistake.

Why Does Marketing Failure Account for So Many Startup Casualties?

How Does a Poorly Defined Customer Acquisition Cost (CAC) Shorten the Cash Runway?

- The Broken LTV:CAC Ratio: A healthy business model requires LTV to be significantly higher than CAC (ideally 3:1 or more). When a startup relies heavily on expensive paid advertising (PPC, social ads) before achieving PMF, the CAC often skyrockets. If the LTV is low due to high churn (a symptom of poor PMF), the company is essentially spending more to acquire a customer than that customer will ever return. This rapidly depletes the Cash Runway.

- Focusing on Vanity Metrics: Chasing “likes,” “followers,” or “impressions” instead of revenue-generating metrics (leads, conversions, LTV) leads to wasted marketing spend and a false sense of progress.

Why is a Lack of Startup SEO a Fatal Mistake for Early-Stage Companies?

- Reliance on Paid Channels: Paid advertising provides instant results but stops the moment the budget runs out. By neglecting Startup SEO, a company builds no long-term, compounding asset. Organic traffic, while slower to build, provides free, high-quality traffic that constantly proves Market Demand and lowers the overall CAC.

- Failure to Build Authority: SEO is not just about rankings; it’s about establishing topical authority. A startup needs to be seen as the expert in its niche. This requires a robust content strategy, technical excellence, and a strong digital foundation, something a specialized agency in Startup SEO can provide.

What are the Consequences of Ignoring Distribution Channels?

- Misunderstanding the Customer Journey: Founders often assume customers will find them. They fail to identify the specific channels (e.g., industry forums, specific social media platforms, niche blogs) where their Ideal Customer Profile (ICP) spends time.

- The “Build It and They Will Come” Fallacy: This mindset is a direct path to failure. Distribution is not passive; it requires a dedicated strategy, whether through content marketing, strategic partnerships, or a focused sales effort. The most successful startups master one distribution channel before attempting to expand to others.

How to Avoid Startup Failure: A Strategic Framework

1. Master the Product-Market Fit Equation

- Validate the Problem, Not the Solution: Start with intense customer discovery. Interview potential users to understand their pain points, not to pitch your product. Use the lean startup methodology to build a Minimum Viable Product (MVP) and iterate rapidly.

- Define Your Ideal Customer Profile (ICP): Be laser-focused on a niche market first. A product for “everyone” is a product for no one. Once you dominate a niche, you can expand.

- Measure PMF Quantitatively: Use metrics like the Net Promoter Score (NPS), retention rates, and the Sean Ellis Test (asking users how disappointed they would be if the product disappeared) to confirm PMF before moving to the next stage.

2. Protect Your Cash Runway

- Budget Conservatively: Always assume revenue will come in slower and expenses will be higher than projected. Maintain a detailed, rolling 12-month financial forecast.

- Prioritize Profitability: Focus on a clear path to generating positive cash flow. While venture capital can accelerate growth, a sustainable business model must be the ultimate goal.

- Optimize Operations: Implement systems for efficient project management from day one. Tools like Kendo Manager can help teams track progress, manage resources, and ensure every dollar spent contributes directly to a key milestone.

3. Build a Resilient and Skilled Team

- Address Founder Conflict Early: Establish a clear, written Founder Agreement that defines roles, responsibilities, decision-making processes, and a vesting schedule for equity. This prevents ambiguity and conflict down the line.

- Hire for Blind Spots: If the founders are technical, hire a sales leader. If the founders are sales-focused, hire a strong technical lead. Ensure the team’s skills cover the three pillars of a startup: product, sales, and operations.

- Foster a Culture of Transparency: Open communication about the company’s challenges, including the Cash Runway, builds trust and allows the team to collectively solve problems.

4. Invest in Strategic Digital Visibility

- Prioritize Startup SEO: For any new venture, organic traffic is the most sustainable and cost-effective source of leads. Work with an agency that understands the nuances of Startup SEO to build a strong foundation. This includes technical SEO, content strategy focused on high-intent keywords, and link building.

- Build a Robust Digital Home: Your website is your 24/7 sales representative. Invest in professional web development [6] to ensure a fast, secure, and user-friendly experience. Poor design and slow loading times are often the first things that turn away potential customers.

- Focus on Content Authority: Use content to establish your company as a thought leader in your niche. Create comprehensive guides and case studies that address the specific problems your target audience is searching for.

Turning the 90% Statistic into an Opportunity